Liquidation

Overview

What is Liquidation?

When providing collateral to borrow on the Earn platform, it is important to maintain collateralization ratios within the stated bounds. If a user's account becomes under-collateralized, they may face a liquidation event where a portion of their collateralized deposits are liquidated to repay part of their outstanding loan. Exchange rates are a key variable in the collateralization ratio and volatility in digital currency markets is significantly higher than fiat currency markets.

Each market specifies a maximum loan to value ("LTV") ratio that a user must observe in order to avoid a liquidation event. If a user exceeds the LTV ratio, a portion of their outstanding loan becomes eligible for liquidation. There is the option to repay currency borrowed or add collateral, but if a user fails to do so, other users can pay off a portion of the loan at a discounted rate (10% discount) and seize collateral.

The 3 States:

Assumption: maximum LTV ratio is set at 80% for the assets being used as collateral.

Good standing = the collateral supplied satisfies the loan to value rate of borrowed currency.

Recoverable Default = borrowed currency levels are covered by collateral available without risk of loss.

Unrecoverable Default = deposited collateral cannot cover the underwater or bad liquidation.

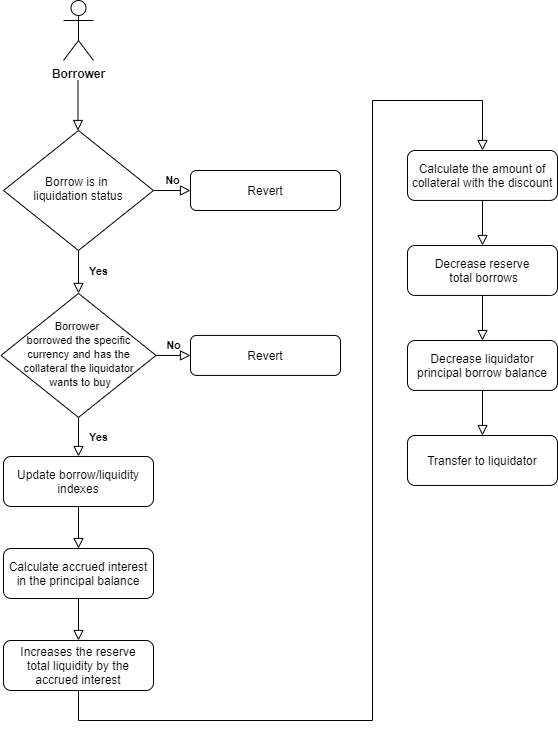

Flow Chart

This chart describes the flow Earn uses to manage liquidations.

Last updated

Was this helpful?